William Shakespeare

Neither a borrower nor a lender be, for loan oft loses both itself and friend, and borrowing dulls the edge of husbandry. - Polonius, Hamlet Act 1, scene 3, 75–77

You ever get the feeling many of our modern day politicians have forgotten the prescriptive wisdom and life lessons of the classics? I am growing more and more convinced each passing day. Either that or they are just a permanent criminal class as Nock once asserted.

You ever get the feeling many of our modern day politicians have forgotten the prescriptive wisdom and life lessons of the classics? I am growing more and more convinced each passing day. Either that or they are just a permanent criminal class as Nock once asserted.

$85 Billion = AIG

$29 Billion = Bear Stearns

$25 Billion = Big 3 U.S. Auto Companies (Projected)

+

_______

$139,000,000,000.00

Cha-Ching!

I've been bailed out!

Now 2000 U.S. Census statistics say the total U.S. population was 281,421,906 people, the projected population at the time of this post is 305,738,895. Averaged out that is 293,580,400 people in the U.S.A. So these bailouts will cost everyone in the U.S. $473.46 right? Wrong.

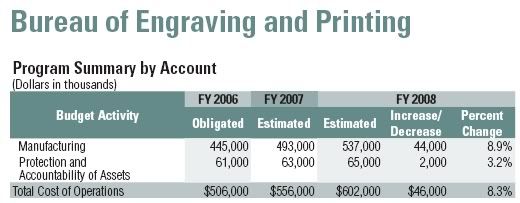

All that money will have to be printed. We are already in debt now. Here are some government stats on the Bureau of Printing and Engraving:

I've been bailed out!

Now 2000 U.S. Census statistics say the total U.S. population was 281,421,906 people, the projected population at the time of this post is 305,738,895. Averaged out that is 293,580,400 people in the U.S.A. So these bailouts will cost everyone in the U.S. $473.46 right? Wrong.

All that money will have to be printed. We are already in debt now. Here are some government stats on the Bureau of Printing and Engraving:

Now the government is pretty mysterious about how many of each note printed and the cost for each of those notes. It is also possible that some of the money will be coined but I don't know for sure. Either way a lot of fiat currency will be printed causing the dollar to be further devalued.

Now this is not even counting the bailouts for housing ($1.3 to $1.6 Trillion) or student loans also being done. I'm not enough of a mathematician for that but here is another analysis by a sharper mind who says that the cost will be an average of $7,541 per U.S. taxpayer on average but interestingly enough, the more you make, the worse the figure:

Now this is not even counting the bailouts for housing ($1.3 to $1.6 Trillion) or student loans also being done. I'm not enough of a mathematician for that but here is another analysis by a sharper mind who says that the cost will be an average of $7,541 per U.S. taxpayer on average but interestingly enough, the more you make, the worse the figure:

Top 1% = $2,980,714

Top 5% = $89,992

Top 10% = $53,012

Top 25% = $25,937

Top 50% = $14,619

Bottom 50% = $463

This assumes a total bailout cost of an even 1 Trillion ($1,000,000,000,000) dollars. So if you work at McDonalds flipping burgers, this will cost you most of your 2 week paycheck. Now, lets say you are at the other end of the spectrum, you are making $250,000 - that ever so controversial bracket that may or may not see a tax cut or tax increase under our new president, it will take you almost 12 years to pay off the bailout. Now, closer to reality for some of us, lets say your family is making $100,000 a year, plus or minus a few grand - you are probably forfeiting your whole year's income to bail out these jerks.

The more I write, the more my head hurts just thinking about it all.

Let's face it, debt equals slavery and our government is making slaves of all of us and it may take time to buy back our freedom.

TTFN,

Jim

The more I write, the more my head hurts just thinking about it all.

Let's face it, debt equals slavery and our government is making slaves of all of us and it may take time to buy back our freedom.

TTFN,

Jim

No comments:

Post a Comment